Should You Buy or Rent in Utah in 2025? A Smart, Value-Driven Guide

At-a-Glance Utah Reality

-

Rent is climbing steadily: Rental housing affordability is shrinking. Affordable units ($600–$999/month) have declined by 53% since 2013, especially in Salt Lake City, where nearly half of renters spend over 30% of their income on housing. (Axios)

-

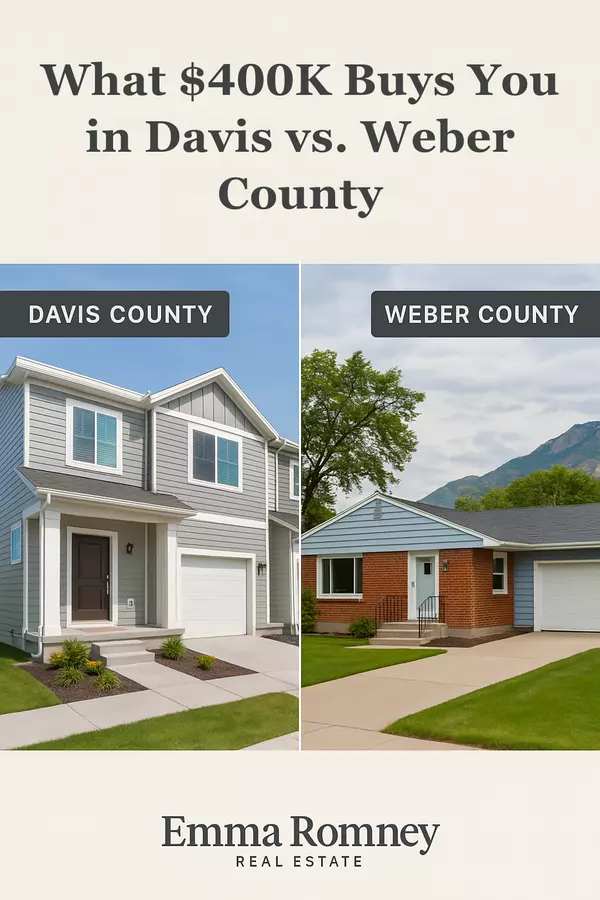

Home prices holding steady: Utah remains one of the nation’s more expensive markets. In 2025, the median single-family home price is approximately $547,700, with home values projected to increase by another 2%. (Fox 13 News Utah)

Buying in Utah: Long-Term Gains, Short-Term Costs

-

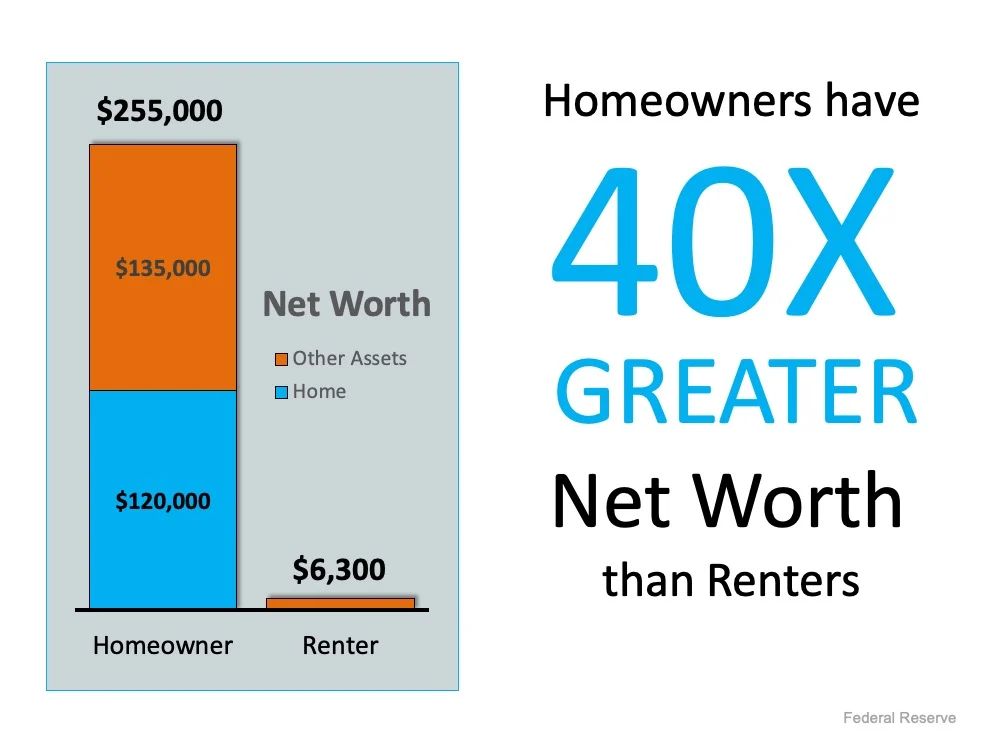

Equity-building powerhouse: Nationally, the median net worth for homeowners is $400K, compared to just $10.4K for renters—about a 40× advantage. (KSL)

-

Utah’s long-term growth is unmatched: Home values have increased 110% over the past five years, compared to ~50% nationwide. (Daybreak Utah Homes)

-

Lock in mortgage rates and protect yourself from rising rents. Houzd estimates that paying $1,800/month in rent with 3% annual increases costs you $240K in 10 years—while a $3,000 mortgage may yield $150K–$200K in home appreciation in the same time. (Houzd)

Renting in Utah: Flexibility… But at What Price?

-

Short-term affordability edge: Renting still costs less upfront. However, the gap between renting and owning continues to narrow, especially in non-coastal markets. (Deseret News)

-

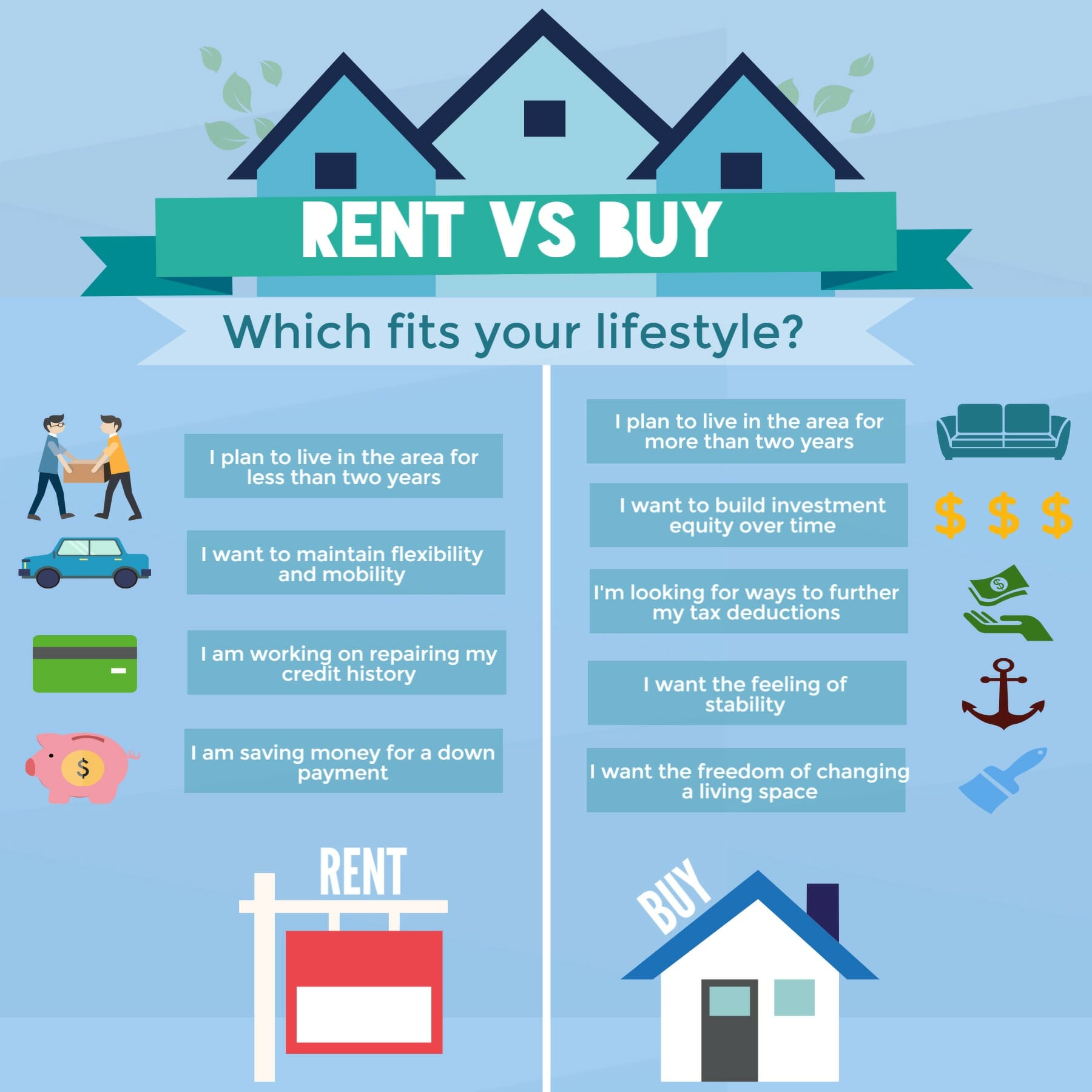

Flexibility and lower commitment: Renting appeals to those who are uncertain about their location, finances, or who need low maintenance. Yet, for many Utahns, rent hikes exceed wage growth, making renting less sustainable over time. (Amres.co)

-

Even affluent Utahns are renting: High-income Salt Lake City residents are increasingly choosing to rent over owning to preserve flexibility and avoid high buying costs. (Axios)

Market Conditions Shaping Your Decision

| Factor | Buyers Benefit | Renters Benefit |

|---|---|---|

| Equity & Wealth | Builds long-term wealth via appreciation & equity | None |

| Price Appreciation | Utah: up ~1–2% in 2025 | No upside |

| Rent Costs | Fixed with a mortgage (typically) | Rising rapidly; affordability shrinking |

| Flexibility & Commitment | Less flexibility, higher upfront cost | High flexibility, lower upfront cost |

| Economic & Market Stability | Strong long-term value in Utah | Short-term breathing room, but trending unstable |

Final Take: What Might Be Best for You?

Buying Makes Sense If:

-

You plan to stay in Utah for 5+ years.

-

You can afford a down payment and a mortgage.

-

You want to build equity and hedge against inflation.

-

Long-term financial stability and wealth-building matter to you.

Renting May Work If:

-

You’re unsure about staying long-term or relocating soon.

-

You need flexibility or have limited savings.

-

You face housing market challenges (e.g., a lack of inventory or tight credit).

-

You value hassle-free living and minimal maintenance.

What the Numbers Tell Us

-

Renting might seem cheaper now, but equity and appreciation make buying a powerful long-term strategy.

-

Utah’s robust housing market and significant home-price gains amplify buyer benefits.

-

Renting still holds appeal for newcomers and those seeking a flexible lifestyle, but affordability is shrinking rapidly.

Categories

Recent Posts