How to Get Started Investing in Real Estate in Utah: A Step-by-Step Guide + Proven Strategies

If you’ve ever asked, “How do I get started investing in real estate in Utah?”, you’re in the right place. In this article, you’ll get:

-

A clear step-by-step path for beginners

-

The top investment strategies (buy & hold, fix & flip, short-term rentals, BRRRR)

-

What you must consider specifically in Utah’s market

-

Tips to avoid pitfalls

-

And, ultimately, how working with a local real estate expert gives you a serious advantage

Utah Real Estate Market Snapshot (2024–2025)

Before you invest, you’ve got to understand the market where you’re placing your capital. Here’s a brief snapshot:

-

The median home price in Utah is currently in the $ 560,000–$ 575,000 range, up ~4–8% year over year.

-

The days on market have hovered around 50–60 days in many areas, indicating moderate movement.

-

Inventory is rising in some Utah submarkets (which gives more opportunity) even as demand remains strong.

-

Utah benefits from strong population growth (~2.5 % annually projected) and job growth (~3 %)

-

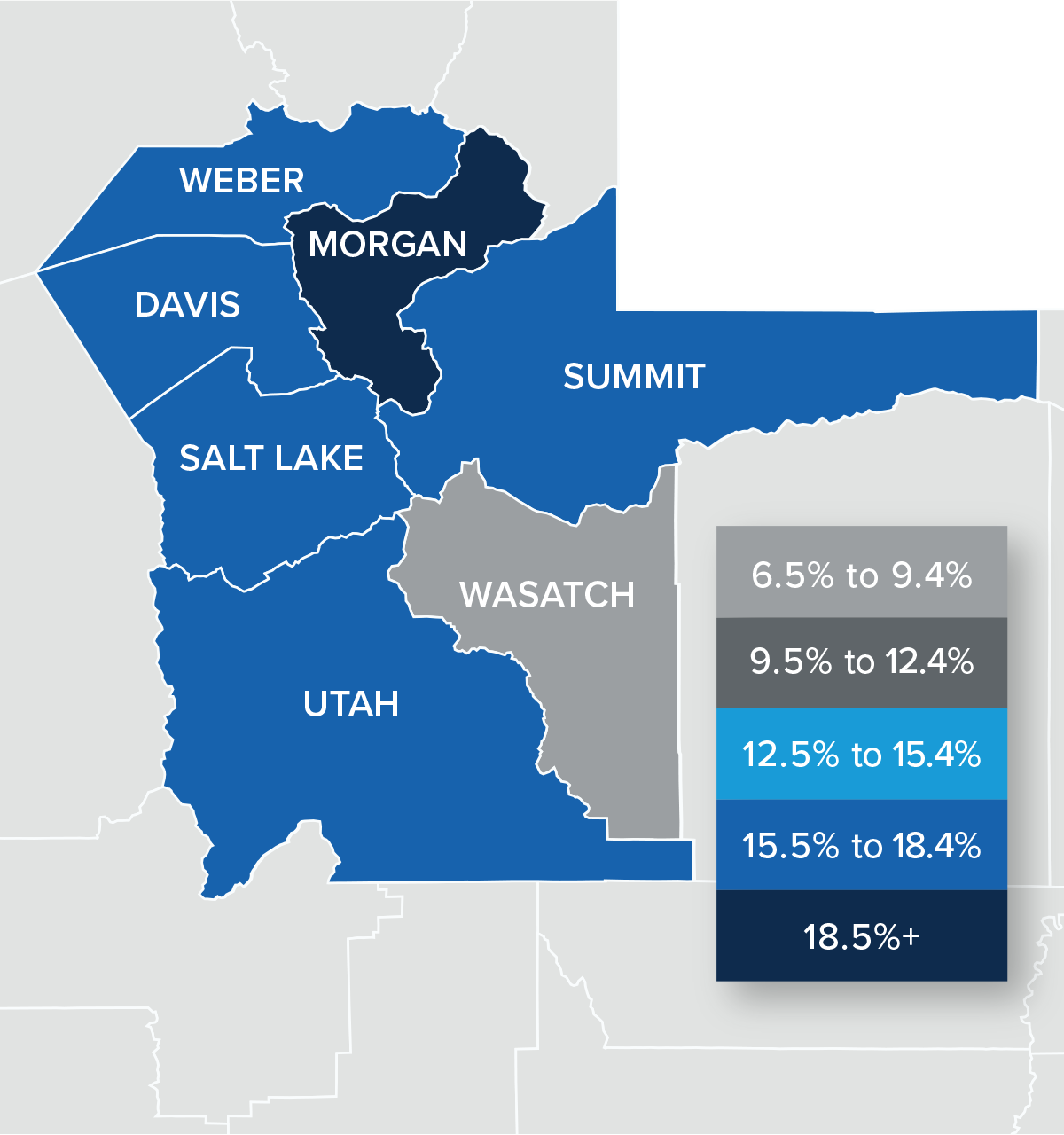

Different parts of Utah are performing differently — urban areas versus rural, ski counties versus plains, and county to county.

-

Rising home insurance costs (especially in the Salt Lake area) are becoming a non-negligible expense.

Takeaway: The market is still favorable to investors if you know where to look and how to structure deals. But you can’t blindly jump in.

Step-by-Step Guide for Beginners in Utah

Here’s a clean roadmap to get you started:

1. Clarify your objectives and resources

-

Decide what you want: steady rental income, capital appreciation, flipping profits, short-term rental income (Airbnb), or some hybrid

-

Assess how much capital you have (down payment, reserves, closing costs, rehab buffer)

-

Evaluate your risk tolerance and time commitment

-

Make sure your credit, debt-to-income ratio, and financing flexibility are in shape

2. Educate yourself on Utah’s local markets and submarkets

-

Tour neighborhoods in Salt Lake County, Utah County, Davis County, Weber County, Wasatch, Summit, and more

-

Watch for infrastructure developments (transportation, new highways, schools)

-

Join local real estate investment groups like Utah REIA to hear from seasoned investors in your area

-

Use MLS data, rent comparables, vacancy rates, and development pipelines

-

Understand local zoning, land use, HOAs, and short-term rental regulations (some cities are restrictive)

3. Build your team before you need them

You don’t have to go it alone. A solid team is essential:

-

Realtor/broker who knows investment properties and local submarkets (that’s where I come in)

-

Lender/mortgage broker experienced in investment property financing

-

General contractor/rehab crew

-

Property manager (if you don’t want to self-manage)

-

Accountant/tax advisor familiar with real-estate deductions, depreciation, 1031 exchanges, etc.

4. Choose your investment strategy (or mix of strategies)

Here are the most common strategies that work in Utah:

a) Buy & Hold / Long-Term Rental

-

Buy a property, rent it out long term (1+ year leases), and cash flow it

-

Ideally, in areas with solid job growth and population growth

-

Use leverage (mortgages) to amplify returns

-

Over time, benefit from appreciation + tax deductions

-

This is generally lower-risk, slower growth, steady income

b) Fix & Flip (Renovate & Resell)

-

Buy a distressed or undervalued property

-

Renovate (cosmetically or more extensively)

-

Sell it for a profit

-

Timing and rehab cost control are critical

-

In Utah, competition and higher costs of labor/materials make precise budgeting key

-

Financing often involves hard money / private money for short-term projects

c) Short-Term / Vacation Rentals (Airbnb, VRBO)

-

Especially appealing near ski resorts, national parks, or tourist destinations

-

Utah’s natural beauty (mountains, national parks) gives upside potential

-

But watch for regulation, local ordinances, higher operating costs, and seasonality

-

You’ll need to manage turnover, marketing, cleaning, and compliance

d) BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat)

-

A hybrid: buy distressed → rehab → rent → refinance → pull out capital, then repeat

-

Allows “recycling” your initial capital to scale your portfolio faster

-

Commonly used by active investors across the U.S.

-

Must manage rehab budgets, refinance risk, and market timing carefully

e) Syndications, REITs, or Crowdfunding (indirect)

-

Don’t want hands-on? You can pool money with others or invest passively

-

REITs allow exposure without owning physical properties; crowdfunding is riskier but potentially higher return

-

But Utah-specific deals via syndication may be harder to source as a beginner

What to Consider Especially in Utah’s Markets

When applying the above strategies to Utah, here are special things to watch:

A. Submarket selection is crucial

-

In Provo/Orem: high demand for student housing

-

In Lehi/Silicon Slopes: strong appreciation and job growth

-

In resort/mountain regions (Heber, Park City, Deer Valley): short-term/vacation rentals might shine

-

In suburban commuter zones (Draper, Saratoga Springs, Herriman): mixes of long-term rentals offer stability

-

Rural vs urban: rural areas may have lower prices, but slower appreciation

B. Tax, insurance, and regulatory environment

-

Utah offers favorable landlord laws, depreciation, and tax deductions

-

Be aware of rising insurance costs (especially for properties in risk zones)

-

Local regulations: Some cities heavily regulate short-term rentals

-

Utah’s Condominium Act (for condo investments) provides a legal structure for condo ownership in Utah

C. Financing challenges & creative strategies

-

Conventional mortgages often require higher down payments and stricter qualifications for investment properties

-

Hard money/private money can bridge deals for fix & flip or BRRRR deals

-

Use creative financing: seller financing, subject-to, lease-option, partnerships

-

Always have reserves — Utah markets can get competitive and interest rates unpredictable

D. Exit strategy and liquidity

-

Don’t get locked into a property without knowing how/when you’ll exit

-

In slower submarkets, holding properties might take longer to sell

-

Have contingency plans if vacancy spikes or rehab runs over budget

E. Risk mitigation & conservative underwriting

-

Assume vacancy, maintenance, and capex

-

Stress-test your cash flow versus a slight rent dip or interest rate rise

-

Start small — maybe 1–2 properties before scaling

-

Always run comps, do due diligence, and inspect thoroughly

Sample First-Year Plan for a Utah New Investor

Here’s what your first year might look like:

| Phase | Action Items |

|---|---|

| Months 1–2 | Educate yourself, join Utah REIA, connect with a local realtor/investment agent (me), and meet lenders |

| Months 3–4 | Review submarkets, drive areas, get familiar with MLS, run deal analyses with comps, and rent data |

| Month 5 | Get financing pre-approval or lines of credit, identify 2–3 potential deals |

| Months 6–8 | Underwrite, make offers, negotiate — maybe start with a small duplex or single-family that needs limited rehab |

| Months 9–10 | Close, renovate, lease to tenants, or list for resale |

| Months 11–12 | Stabilize, analyze performance, plan next move (BRRRR, add more units, expand) |

If you follow that plan, by year-end you’ll have one live property, real deal analysis experience, and a clearer sense of which strategy fits your goals.

Why Working with Me, Your Local Utah Realtor, Gives You a Big Edge

You might ask, “Why do I need to partner with a realtor?” Here’s where I add value to your investing journey:

-

Deep local knowledge: I know which neighborhoods are overheating, where appreciation is accelerating, which cities allow short-term rentals, and which ones don’t.

-

Access to off-market deals/early MLS intel you won’t find looking from out of state.

-

Network of contractors, property managers, and inspectors — I can introduce you to vetted professionals.

-

Deal analysis guidance: Help you run accurate comps, stress test cash flow, and evaluate risks

-

Negotiation strength and support through the closing process

-

Strategic scaling advice: Once you’re ready for your next property, I’m by your side

In short: you lean on me to reduce your learning curve, avoid mistakes, and move faster.

Let’s Take the First Step Together

If you’re serious about investing in real estate in Utah but don’t want to leave things to chance, I’d love to help you:

-

Schedule a discovery call with me — we’ll review your goals, budget, and timeline

-

I can run a no-commitment deal analysis on a few Utah neighborhoods for you

-

I’ll introduce you to trusted lenders, contractors, and property managers

-

Let’s walk through some neighborhoods together and pinpoint submarkets with the best potential

Investing in Utah real estate can be one of the most reliable paths to building wealth, provided it is done correctly. Don’t go it alone — let me be your local partner in making it happen.

Contact me below to get started!

Sources

-

Bankrate, “Utah Housing Market”

-

Redfin, Utah Housing Market Trends

-

Rentastic, Best Cities for Real Estate Investment in 2025

- Rentastic, Utah Real Estate Marketing Trends in 2025

-

ARTI Academics, Real Estate Investment Strategies in Utah

-

Utah REIA, Investor Resources

-

Axios / Local News, rising insurance in Salt Lake area

Categories

Recent Posts