Is Now a Good Time to Buy a Home in Utah? What Realtors Need to Know

As Realtors in Utah, your clients increasingly ask: “Should I buy now, or wait?” The answer depends on a few key market factors: home prices, mortgage interest rates, housing inventory (supply), demand (absorption), and affordability. Below is a deep dive into current Utah market data (2025), plus what these indicators suggest for buyers and sellers.

Key Market Indicators Right Now in Utah

| Indicator | Current Data / Trend | What It Means |

|---|---|---|

| Median Home Prices | Utah’s median home price is around $576,300 (all home types) as of August 2025, up about 5.1% year-over-year. In January 2025, the median was ~$566,800, up ~7.9% from January 2024. |

Prices are still appreciating, though growth seems to be moderating somewhat. Buyers need to be prepared to pay above the previous year’s norms; sellers still benefit from gains. |

| Mortgage Interest Rates | 30-year fixed rates in Utah are currently around 6.47%, while 15-year rates are approximately 5.74%. Some lenders offer rates as low as 5.99% for a conforming 30-year fixed loan, depending on the lender/credit. (City Creek Mortgage) |

Rates are elevated vs historic lows, reducing affordability. Higher rates increase monthly payments and reduce buyer leverage. But rates have stopped spiking aggressively lately. |

|

Active Listings / Inventory |

~14,070 active listings statewide (Aug 2025) in Utah. Listings have surged (~33% increase in some reports). |

More inventory means more choices for buyers and less pressure to “win at all costs.” It is shifting some power toward buyers in specific or less competitive neighborhoods. |

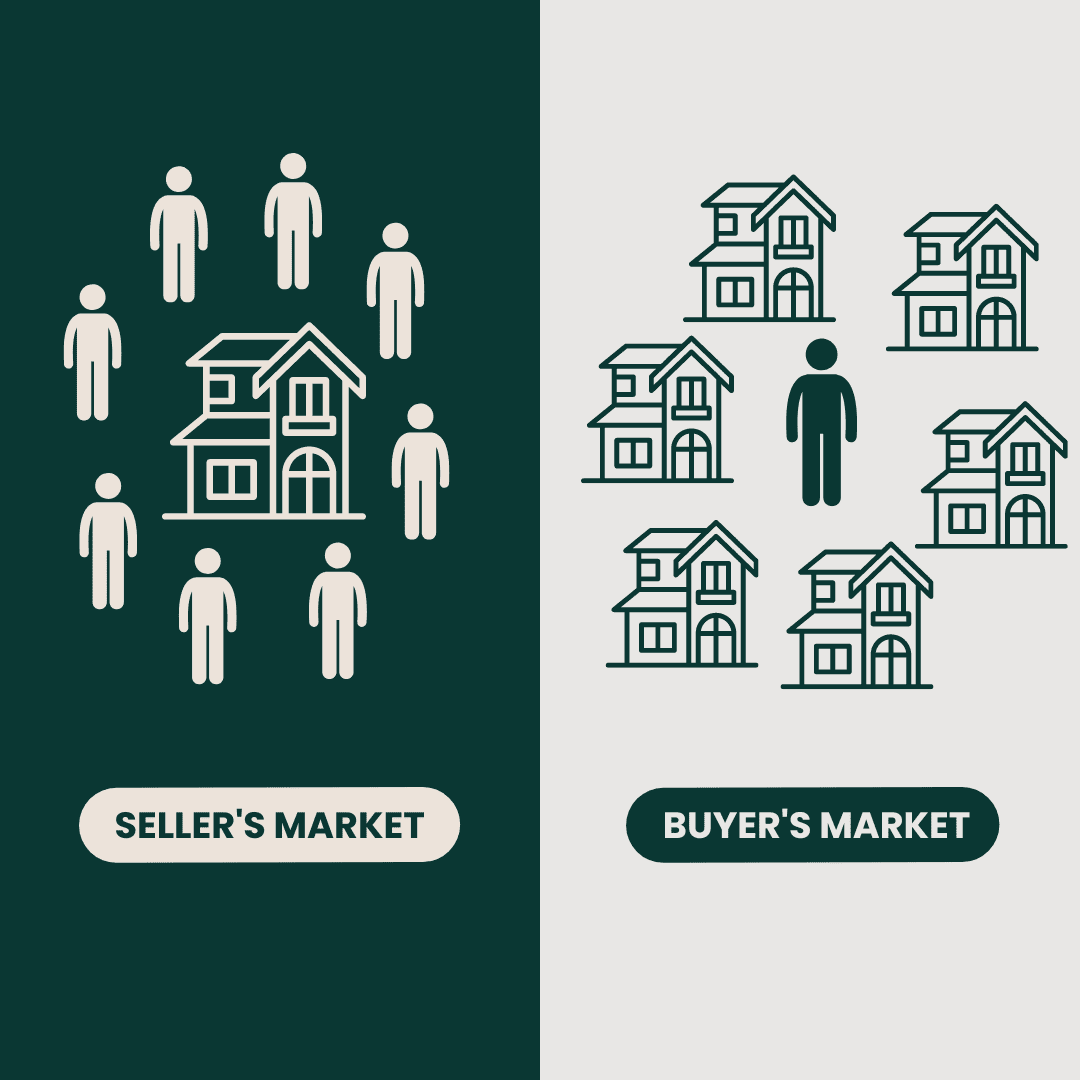

| Months of Supply / Absorption Rate | In places like St. George and Cedar City, supply has moved to ~4.6 to 5 months. Statewide reports indicate slow sales, with some areas showing a 6-month supply. |

Between 4 and 6 months is often considered a “balanced market.” Below ~4 months favors sellers; above ~6 months signals a buyer’s market. Utah is nearing balance in many regions; in less desirable or higher-cost areas, buyer leverage is increasing. |

| Days on Market | Homes are staying on the market longer year-over-year. E.g., median days on market ~51-60+ days in many parts. | More breathing room for buyers — less urgency, more room for inspections, negotiations, or concessions. Sellers may need to adjust strategies. |

What These Trends Mean: Buyer vs Seller Advantage

-

Buyer’s leverage is increasing: With more inventory, longer days on market, and higher rates making affordability tighter, well-qualified buyers have stronger negotiating power. Seller concessions, price reductions, or incentives are more common in certain segments (e.g., condos/townhomes, higher price brackets).

-

A seller’s market still prevails in some areas/price points, particularly in high-demand areas such as the Wasatch Front (including Salt Lake City, Provo-Orem, and Utah County), luxury segments, or properties in excellent condition, where competition remains strong. Homes that are well-priced, well-staged, or in desirable neighborhoods still often sell faster.

-

Interest rates are the wildcard: Even though rates are high, many experts do not expect dramatic drops in the near term. Elevated borrowing cost erodes affordability. Buyers need to factor that into the monthly payment, as well as the total cost of ownership, including taxes, insurance, and maintenance.

So, Is Now a Good Time to Buy?

Yes — in certain circumstances. It’s not a universal “yes,” but for many buyers, now presents opportunities — especially those who:

-

Have stable income, a strong down payment, and are rate sensitive (i.e., want to lock something before rates rise further).

-

Are flexible on location or willing to consider townhomes, condos, or non-prime neighborhoods, which are showing softened price pressure.

-

Are willing to move reasonably quickly (pre-approval, inspections, etc.) to take advantage of favorable supply in some areas.

For others, it might make sense to wait for slightly better conditions if they:

-

Are highly rate-sensitive and expect mortgage rates to drop meaningfully.

-

Need to stay within tight budget constraints, where even small increases in rate or price make a significant difference.

-

Are looking in very competitive markets/popular neighborhoods, where seller’s market dynamics still dominate.

Strategies for Realtors to Advise Clients

Here are action items Realtors can use with clients to help them decide:

-

Run affordability scenarios: Show clients monthly payment sensitivity with interest rate changes (e.g., 6.5% vs 7.5%) and how that affects what they can afford without overextending.

-

Monitor local supply & absorption by price segment: The overall inventory numbers mask a huge variance by price (under $300K, $300-700K, etc) and by area. Some price tiers are much more competitive.

-

Negotiate concessions: In many areas, sellers are more open to buyer requests (repairs, closing cost help) due to softer competition. Teach buyers to look for signs (such as long days on market and price drops).

-

Lock rates if feasible: If a buyer sees a rate they’re comfortable with, locking sooner rather than later can protect against unpredictable rate movements.

-

Educate sellers on pricing and presentation: Sellers should understand that overpricing risks longer market time; presentation, staging, and pricing to market are more critical now.

-

Stay agile: Markets can shift fast. Federal rate policy, local building permits/new construction, as well as migration patterns (people moving in/out) can adjust supply + demand quickly.

Forecast & What to Watch for in the Coming Months

-

A slight moderation in price growth (2-4%) is likely in many Utah metros. The median price increases will continue, but perhaps not at the double-digit pace seen earlier.

-

Mortgage rates are likely to remain elevated, possibly easing slightly but unlikely to plunge in the short term. Inflation, Fed policy, and bond yields will continue to put pressure on.

-

Inventory is expected to continue increasing (with more listings), especially in the mid- to higher-price bands. That will favor buyers more.

-

Job growth, population migration into Utah (especially into the Wasatch Front, Silicon Slopes region) will continue to underpin demand.

Bottom Line

For many clients, now is a good time to buy, especially if they are prepared and realistic. The balance of power is shifting toward buyers in many parts of Utah, offering more choices, more negotiation room, and less frantic competition; however, affordability remains an issue due to elevated interest rates.

As a Realtor, your role is to help clients weigh trade-offs: paying a bit more now versus waiting (and hoping rates drop or inventory improves), or finding value in less obvious neighborhoods or housing types.

Sources

-

Redfin – Utah Housing Market: median home price, inventory, days on market data

-

Bankrate – Utah mortgage rates and housing market trends

-

City Creek Mortgage – current Utah 30-year and 15-year fixed rates

-

Cloudfront Kem C. Gardner Institute / “State of the State’s Housing Market 2024-2025” report

-

The Salt Lake Tribune / SLTrib article on Federal rate cuts and local impact

Categories

Recent Posts