Is Now a Good Time to Buy a House? Here's Your 2025 Guide

Why “Is Now a Good Time to Buy a House?” Dominates Searches

Homebuyers are constantly Googling variations like “is now a good time to buy a house”, “best time to buy a house 2025”, or “housing market predictions 2025.” These high-intent queries reflect the urgency around ideal timing, affordability, and market conditions.

Recent data reveals:

-

Redfin’s Chief Economist: “Now is a good time to buy, if you can afford it. Prices are climbing, but lower mortgage rates and greater inventory give buyers negotiating power.” (Redfin)

-

Barron’s: Home prices have slowed for five consecutive months, the median existing-home price holds steady (~$422K), and mortgage rates dipped to ~6.52%. Sellers are offering incentives. (Barron's)

-

Business Insider/Redfin: Home prices declined in 14 of the 50 largest metro areas; buyer concessions (like rate buy-downs, paying repair costs) are near-record. (Business Insider)

-

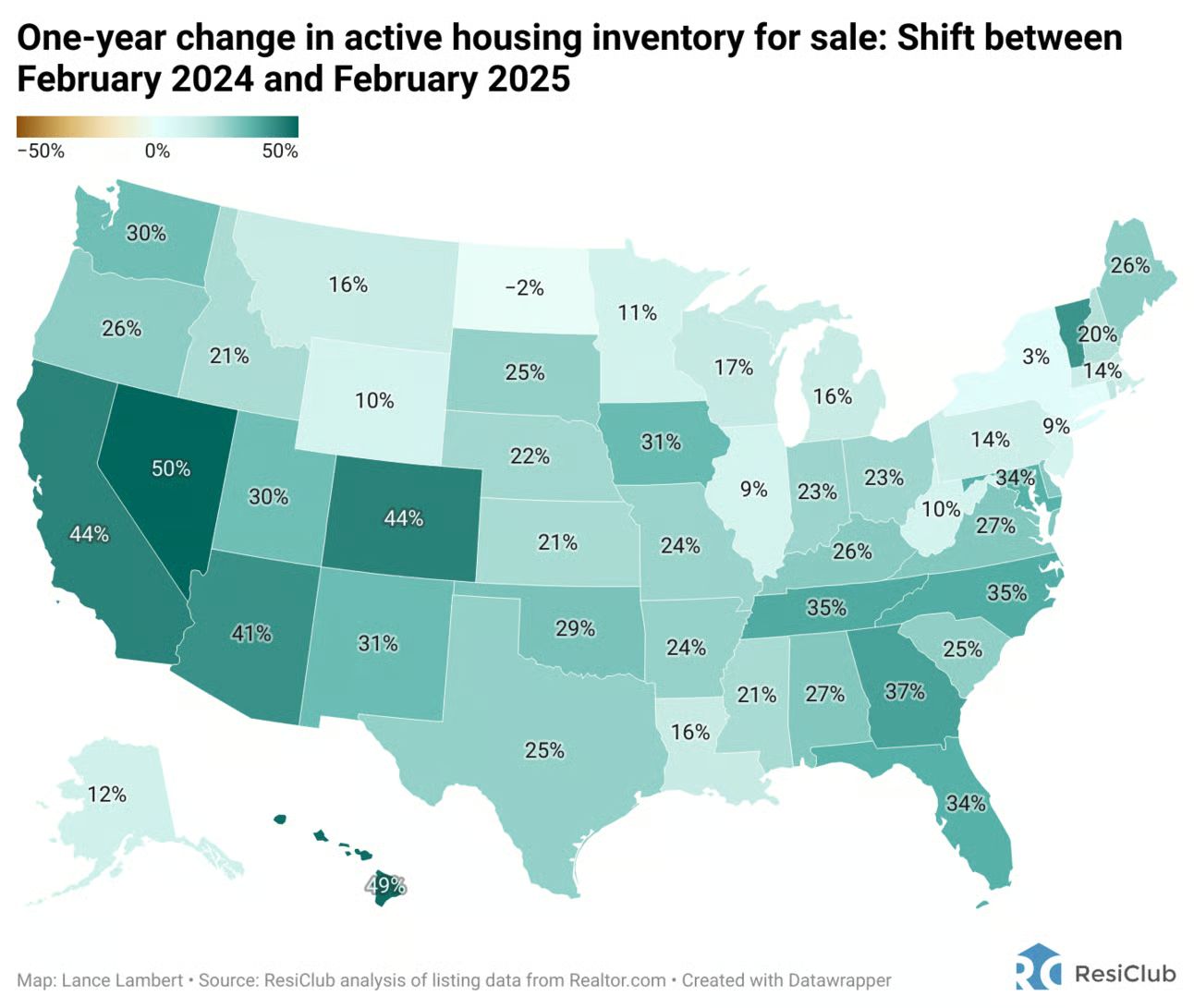

Realtor.com (July 2025 report): Inventory rose 24.8% year-over-year, unsold homes up 16.9%, homes remain on market longer (median 58 days)—favoring buyers. (Realtor.com)

Current Market Snapshot: Is It Favorable for Buyers?

Yes—but with caveats.

| Market Factor | Status (Mid-2025) |

|---|---|

| Mortgage Rates | Around 6.5–6.6%, near yearly lows (Wall Street Journal) |

| Inventory Levels | High—21 consecutive months of growth, post-pandemic highs (Realtor.com) |

| Price Trends | Slowing growth; flat in many markets (Barron's) |

| Buyer Leverage | Stronger—sellers offering concessions, more negotiating power (Business Insider) |

| Regional Variation | Certain Utah metro areas, such as Park City or parts of the Wasatch Range, are experiencing cooling or flattening prices, while others, like Provo, Spanish Fork, and Riverton, remain tight and competitive. (Market Watch) |

When “Now” Isn’t the Best Time

-

Unaffordable financing: High mortgage rates are still a barrier; homes remain out of reach for many (Reuters)

-

Tight markets persist: Salt Lake City and other parts of Utah are still face tight housing markets. Low inventory continues to fuel competition, keeping buyers on edge. (Axios)

-

Waiting trade‑off: Buyers may delay, but risk higher prices or missing out on favorable seller incentives (New York Post)

Smart Buying Tips for 2025

-

Run a mortgage calculator: Figure out what you can realistically afford.

-

Lean into inventory: Use high listings and longer market days to your advantage—ask for seller concessions or repairs.

-

Target local value: Consider emerging value hubs like Ogden, St. George, or parts of Utah County—where relative affordability has improved and buyer opportunities are growing. (Axios)

-

Prepare finances thoroughly: Pre-approval, strong credit, down payment readiness = strengthened negotiating power.

-

Track rate shifts: Even a drop to ~6% could ignite affordability for millions. (New York Post)

FAQ

Q: Should I wait for mortgage rates to drop below 6% before buying?

A: Even slight drops unlock affordability—NAR estimates 5.5M households could buy at 6%, with 550K more joining over 12–18 months. But waiting risks losing lower prices or seller incentives today. (Redfin)

Q: Are home prices likely to fall further this year?

A: Modest declines (up to 5%) are possible if inventory remains high and rates lighten—but in many areas, prices are stabilizing. (Barron's)

Q: What cities in Utah offer the best buying power right now?

A: Consider emerging value markets like Tooele, Eagle Mountain, Saratoga Springs, Ogden, and Cedar City—where home affordability is notably better. Still, keep in mind that inventory remains limited in many areas.

Takeaway:

Yes—if you’re financially ready, now is a favorable window to buy:

-

Rates have dipped,

-

Inventory is elevated,

-

Sellers are motivated,

-

Prices aren’t rising as fast.

But affordability challenges remain—so you must be strategic, financially prepared, and open to regional opportunities.

Categories

Recent Posts