Pre-Qualification vs. Pre-Approval in Utah: What You Need to Know (2025)

Quick Answer

-

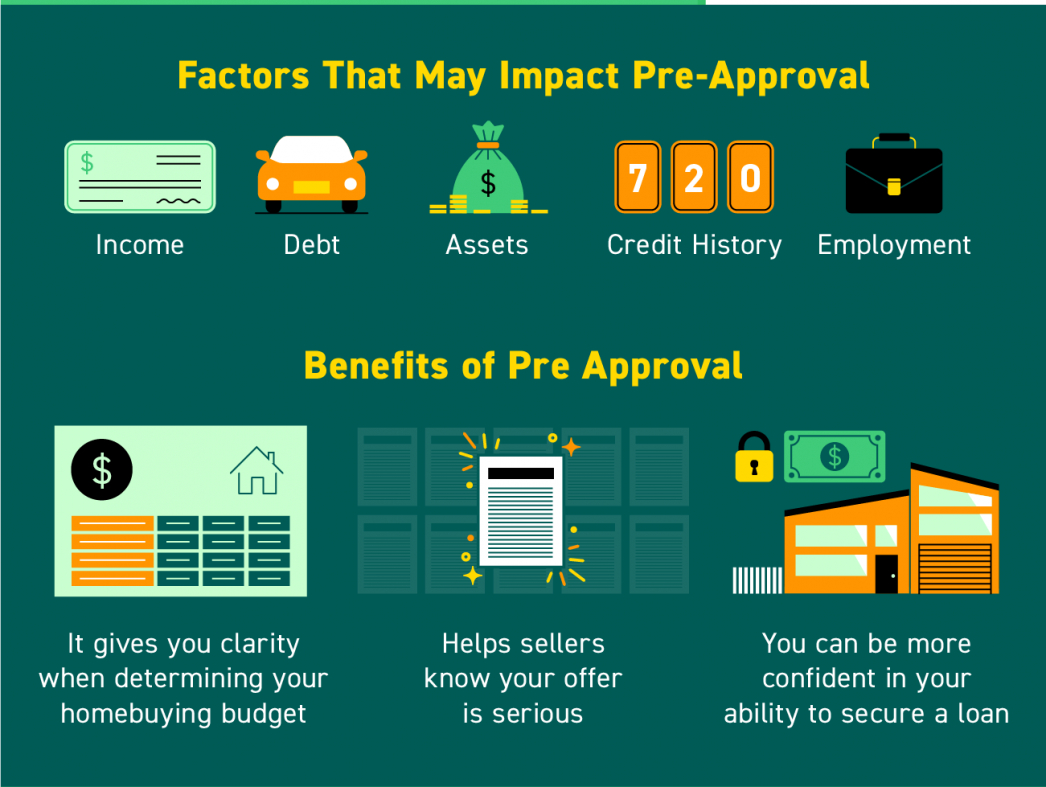

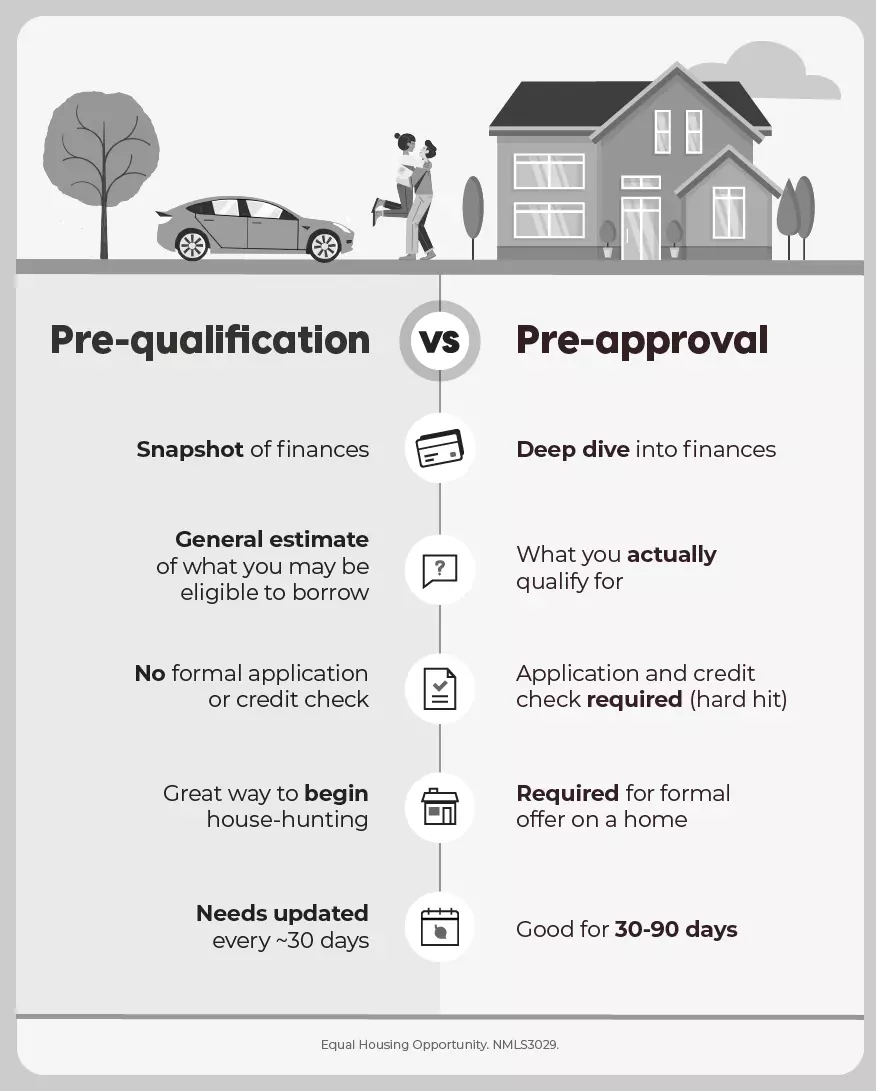

Pre‑Qualification is an informal estimate—no paperwork or credit check required. It gives you a ballpark of how much you might be able to borrow. (The CE Shop)

-

Pre‑Approval is the real deal: you submit full documentation, your credit is checked, and you receive a formal letter that shows sellers you’re a serious buyer. (Real Estate Witch)

Why It Matters in Utah’s Housing Market

Utah’s market is competitive—hot metros like Salt Lake City and rapidly growing areas across Utah County move fast. A pre‑approval letter signals that you’re not just shopping around—you’re ready to act, which is especially powerful when multiple offers are the norm. (Best Utah Real Estate)

What Each Step Involves

| Step | Utah Pre-Qualification | Utah Pre-Approval |

|---|---|---|

| Process | Soft estimate via phone or online; no proof needed | Formal application with documentation & credit check |

| Purpose | Gauge affordability quickly; ideal for early stages | Lock in your buying power; sellers take you seriously |

| Credit Impact | Soft pull or none | Hard inquiry (briefly affects credit score) |

| Seller Perception | Low — just an estimate | High — shows readiness to purchase |

| Validity | No formal expiration | Typically valid 60–90 days ($$ lock-in window) |

Utah-Focused Tips

-

Start with Pre‑Qualification

Get a quick idea of your budget before getting serious. It’s a low-effort first step. (Advanced Funding Home Mortgage Loans) -

Move to Pre‑Approval When You’re Ready

Gather pay stubs, W-2s, bank statements, and ID. Apply with a local Utah lender familiar with the market, which helps streamline the process. (Real Estate Witch) -

Strategize Timing

Complete pre‑approval just before you start touring houses—with validity between 60–90 days, it matches Utah’s fast-moving market (Investopedia) -

Use It as a Competitive Edge

In markets like Salt Lake City, a pre‑approval letter can make your offer stand out—especially in bidding wars for entry-level listings. (Best Utah Real Estate)

To Sum it Up

In Utah’s fast-paced real estate scene, a pre-qualification gives you a quick affordability snapshot. But a pre-approval is what sellers and agents respect—it signals serious intent and positions you better in competitive markets. Be ready with documentation, submit your pre-approval near your house-hunting start date, and watch your buying power grow.

Categories

Recent Posts